TABLE OF CONTENT

Centralized Data Management

Automated Processes

Improved Regulatory Compliance

Enhanced Customer Service

Real-Time Reporting

Conclusion

Centralized Data Management

Managing data can be complicated and arduous in banking commerce, especially when data is stored across numerous systems and departments. This can outcome in data loss or replication, making it complex to access correct information when demanded.

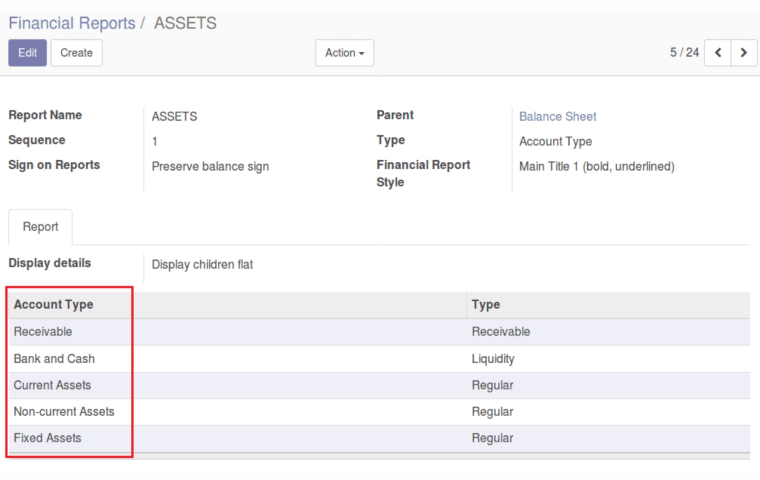

Odoo ERP is a firm resolution for banks that provides a centralized strategy for data administration. With Odoo ERP for banking industry, all data can be stored in one place, accessible to all authorized users across the organization, including:

- Customer data

- Transaction history

- Financial statements

By implementing Odoo ERP for centralized data management, banks can improve team collaboration, enabling faster decision-making and reducing the risk of errors. For instance, if a buyer queries about their account, the customer service representative can rapidly connect the information they demand to respond quickly and accurately. This can assist in enhancing client amusement and retention.

Besides that, Odoo ERP can improve security by making sure that information is stored securely and can only be accessed by certified personnel.

Banks can set up user access managers and permissions to guard sensitive data from unauthorized connections.

Automated Processes

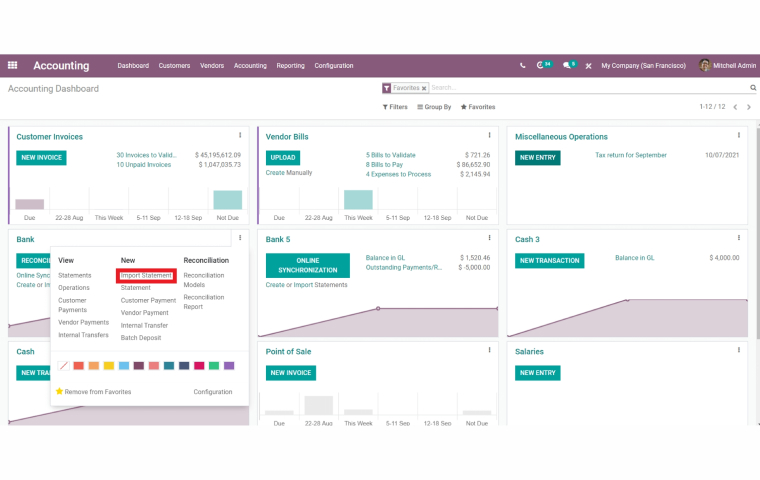

Odoo ERP supplies an extensive range of automation characteristics for the banking industry.

- Creating reports

- Tracking actions

- Controlling client data.

Manual processes can be time-consuming and supine to mistakes, bringing on inefficiencies and weekly influence on the buyer experience. Banks can brutalize many of their progress, reducing the need for manual intervention by carrying out Odoo ERP for banking industry

- Task Qualification: Automation can diminish omissions and allow 11 employees to concentrate on more strategic assignments like resolving information and improving modern products and supports.

- Real-time Track: Odoo ERP can automate the tracking of payments and create reports on overdue accounts, assisting banks to control their cash flow more efficiently.

- Ensuring Regulations: Carrying out Odoo ERP for automated processes can help banks collaborate with KYC and AML. Banks can make sure that they are meeting their administrative demands and avert penalties or lawful problems with inevitable monitoring and reporting devices

Improved Regulatory Compliance

The banking industry is robustly regulated, and conformity can be a crucial threat to banks. Odoo ERP can support banks to assure consent with regulations such as KYC (Know Your Customer) and AML (Anti-Money Laundering) by offering tools for checking and reporting. This can assist banks avoid penalties and legal problems.

Compliance with AML, KYC, and GDPR is critical in banking commerce. Defeat to comply with these adjustments can result in important penalties and reputational loss.

Carrying out Odoo ERP for banking industry can assist banks meet regulatory requirements and avert potential threats.

- Automatic Tools: Odoo ERP offers different tools to assist banks abide by regulations, such as reporting tools and brutalized monitoring. This can support banks to stay on top of any alters to rules and assure they meet their constraints.

- All-in-one Platform: Odoo ERP can keep all admissible information in one area, making it more simple to connect and control.

- Information Security: Banks can also assure that they keep client data secure and preserved by using Odoo ERP for banking industry.

- Accessible Management: The system supplies user access manages and permissions, making sure that sensitive data is only accessible by authorized personnel. This can help prevent data breaches and diminish the threat of non-compliance with regulations such as GDPR.

Banks can gain a competitive benefit by carrying out Odoo ERP for enhanced regulatory conformity. Buyers are increasingly concerned about the protection and seclusion of their information, and banks that can detail their compliance with adjustments are more likely to gain their trust.

Enhanced Customer Service

Providing attractive buyer service is important for banking commerce. Banks enable enhance customer service by providing quick and correct feedback to buyer analyses with Odoo ERP for banking commerce.

- Managing Acceleration: Odoo ERP provides several tools to support banks improve their buyer help. For instance, buyer service representatives can rapidly connect customer info such as transaction records and account features, letting them supply more personalized support.

- Muti-Odoo: Bank can also offer a range of self-service such as mobile apps and online banking by Odoo ERP for banking industry with a wide range of self-service selections. This can supply buyers with greater flexibility and accessibility, permitting them to access their accounts and gain transactions anytime.

- Identify Buyer Behavior: Odoo ERP can assist banks regulate opportunities to upsell and across-sell buyer products and services. Banks can also analyze buyer needs and provide suitable services and products to enhance customer satisfaction and loyalty.

- Buyer Experience Optimization: Automated accomplishes can lessen feedback times, developing the overall customer sustain.

Real-Time Reporting

Odoo ERP can provide giving banks with a more grateful analysis of their financial health and display, and real-time reporting. Banks also can create informed choices and accustoms their plans with correct and suitable reporting. All of this can assist to improve benefits and assure long-term achievement.

- Reporting tools: Odoo ERP offers several reporting tools to help banks achieve insights into their enterprise performance.

- Real-time reporting: Banks can rapidly and accurately assess their financial performance and make informed enterprise selections. Banks can make real-time addresses on a variety of metrics, such as profit, expenses, and buyer attitude with Odoo ERP for banking industry.

- Customer identification: Odoo ERP for banking industry can help banks analyze trends and opportunities for advancement. Banks can identify new products and services in requirements and areas for cost savings and effective improvements by figuring out customer behavior and financial performance.

You might be interested to read more great articles:

Conclusion

Odoo ERP for banking industry can centralize activities, improve compliance, enhance buyer service, and provide real-time reporting. Contact us for expert guidance and support to implement this powerful solution and gain a competitive advantage.